How to Develop a Trading Plan That Enforces Discipline and Ensures Execution

Nov, 19 2025

Nov, 19 2025

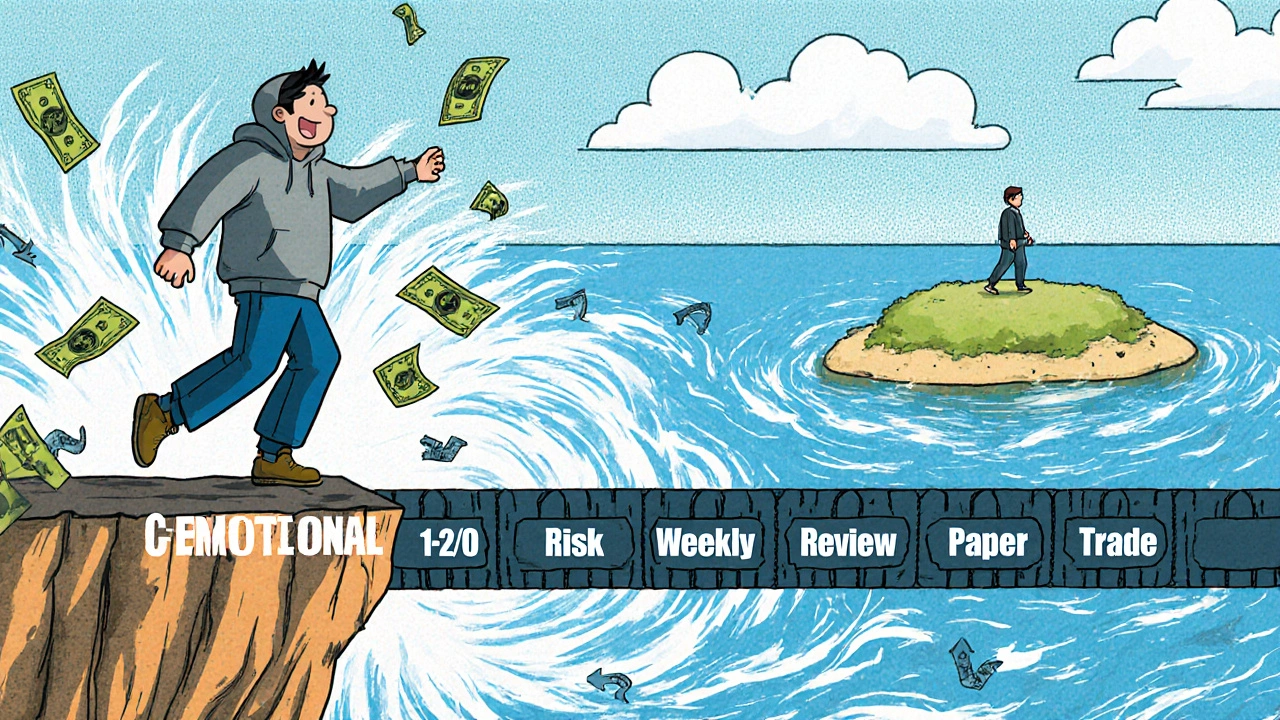

Most traders lose money not because their strategy is bad, but because they break their own rules. You know the drill: you see a setup, you feel the pull to jump in, you ignore your stop-loss, you chase a loss, and suddenly your account is down 20% in one day. It’s not luck. It’s not bad timing. It’s lack of discipline. And the only thing that fixes that is a trading plan-not a vague idea in your head, but a written, tested, and strictly followed system.

Why Your Trading Plan Isn’t Working (And How to Fix It)

You’ve probably heard that you need a trading plan. Maybe you even wrote one once. But if you’re still blowing up accounts, it’s not because you don’t have a plan-it’s because your plan isn’t built for real human behavior. A real trading plan isn’t about predicting the market. It’s about controlling yourself. The best traders don’t have the best indicators. They have the best routines. According to Dr. Brett Steenbarger, former trading coach at NYMEX, the single most predictive factor of success isn’t your entry signal-it’s how often you stick to your plan. Top performers adhere to their rules over 90% of the time. Losing traders? Below 60%. So what’s missing? Most plans are too vague. They say things like “trade with the trend” or “cut losses quickly.” That’s not a plan. That’s a wish. A real plan gives you exact rules for when to enter, when to exit, how much to risk, and what to do when things go wrong.Build a Plan That Actually Gets Used

Start with seven non-negotiable components. Don’t skip any. Each one is a guardrail against emotion.- Define your goals-not “I want to make money,” but “I aim for a 5% monthly return with no single trade risking more than 2% of my account.” Write it down. Put it on your screen. If you can’t measure it, you can’t control it.

- Set hard risk limits-no exceptions. Max 1-2% per trade. Max 3-5% daily loss. That’s not arbitrary. It’s math. If you lose 10% in a week, you need an 11% gain just to break even. Most traders don’t realize how fast losses compound. Your risk limits aren’t suggestions-they’re survival rules.

- Specify your strategy-what exact pattern triggers your trade? Is it a breakout above the 20-day EMA with volume confirmation? Is it a pin bar at a daily support level? Be so specific that a 10-year-old could follow your rules. If you’re guessing, you’re gambling.

- Build an execution checklist-before you click buy, answer these: Is the trend aligned? Is the risk within limit? Is my stop placed? Have I reviewed the last 3 trades? This isn’t busywork. It’s a mental reset. It stops impulsive trades.

- Log every trade-not just the wins. Write down why you took it, how you felt, what you expected, and what actually happened. Do this in real time. No “I’ll do it later.” Later never comes. Use a simple spreadsheet or an app like Edgewonk. If you don’t track it, you don’t learn from it.

- Review weekly-every Sunday, go through your journal. How many trades followed your plan? Where did you deviate? What emotion triggered it? Was it fear? FOMO? Revenge? This is where most traders grow. Not from new indicators-from self-awareness.

- Test before you trade live-backtest your strategy on at least 5 years of data. Then paper trade for 3 months. Don’t skip this. One Reddit trader admitted he paper traded during the calmest market in 18 months. His strategy looked perfect-until live trading hit him with a 23% drawdown in one week.

Choose Your Approach: Simple, Automated, or Structured

There’s no one-size-fits-all plan. But there are proven models.- The 1-Page Plan (Lime Trading)-If you’re overwhelmed, simplify. Write your entire plan on one page. Entry rules, exit rules, risk limits, checklist. No fluff. This works for beginners. One trader increased his monthly returns from -3.2% to +5.7% in six months just by cutting the plan down to essentials.

- The Automated Plan (PineConnector)-If you’re prone to emotional overrides, automate. Use TradingView alerts or a bot to execute your entries and exits. This removes human interference. Users report a 43% drop in emotional trading errors. But beware: if your system fails, you’re stuck. Always have a manual override plan.

- The Structured Routine (FTMO Academy)-This is for swing and position traders. Set fixed times: review the daily chart at market close, update the weekly chart Sunday evening. This builds consistency. Traders using this method showed 22% better performance in trending markets. But during news spikes, rigid timing can cause missed opportunities.

What Experts Say-And What They Warn Against

John Carter of Simpler Trading says traders with written plans outperform the market by 8.2% annually. That’s not hype. That’s data from thousands of tracked trades. But not everyone agrees. Andreas Clenow points out that rigid plans can fail in black swan events. In 2020, 78% of systematic traders got crushed because their stops were too fixed. The lesson? Your plan must allow for adaptation. If volatility spikes, don’t double down. Reduce position size. Adjust your risk. Dr. Van Tharp adds another warning: the 1-2% rule doesn’t work for crypto. Daily swings of 5-7% are normal. If you risk 2% on a coin that drops 6% in a day, you’re out before the trend even starts. For volatile assets, use percentage-based stops tied to ATR (Average True Range), not fixed dollar amounts.Common Pitfalls (And How to Avoid Them)

You’ll run into these. Everyone does.- Journaling fades after two weeks-68% of traders quit tracking trades. Solution? Automate it. Use tools like Edgewonk that auto-import your broker data. Or make it a ritual: every night, spend 5 minutes writing one line: “Did I follow my plan? Yes/No. Why?”

- Ignoring the daily loss limit-One trader lost 23% in a single session because he kept trading after hitting his 5% daily cap. He was chasing losses. Solution? Set a hard rule: after hitting your daily loss limit, close your platform. Walk away. No exceptions.

- Testing in quiet markets-Paper trading during low volatility gives false confidence. Solution? Test during at least one major news event (FOMC, CPI release). If your strategy falls apart when spreads widen, it’s not ready.

- Overcomplicating the plan-Trying to trade 10 indicators at once? You’ll freeze. Solution: One setup. One entry. One exit. One risk level. Master that before adding anything else.

How Much Time Does This Really Take?

You don’t need to spend hours. Start small.- Initial setup: 15-20 hours. Write your plan. Backtest 10 trades. Build your checklist.

- Weekly maintenance: 2-3 hours. Review trades. Adjust risk if needed. Update your journal.

- Long-term evolution: Every 3 months, ask: “What changed in the market? Does my plan still fit?”

What Happens When You Stick to It?

You stop guessing. You stop blaming the market. You stop feeling like a victim. One trader on r/Forex tracked his plan adherence for six months. He discovered he was taking 37% of his trades in the afternoon-his worst-performing time. He stopped trading after 2 PM. His win rate jumped from 41% to 62%. Another trader used the “3-strike rule”: three plan violations in a week meant a mandatory 24-hour break. He didn’t lose a single account after implementing it. Discipline isn’t about willpower. It’s about design. Your plan is your system. Your journal is your mirror. Your rules are your shield. The market doesn’t care if you’re tired, stressed, or excited. It only responds to your actions. If you want to be a consistent trader, you don’t need a better strategy. You need a better system.What’s Next?

Start today. Not tomorrow. Not after your next loss. 1. Open a blank document. 2. Write your goal: “I will make X% per month with no more than Y% risk per trade.” 3. Define your one setup: “I enter when [exact condition] and exit at [exact level].” 4. Set your max risk: “I risk no more than 2% per trade.” 5. Write your checklist: “Before every trade: 1. Trend? 2. Risk? 3. Stop placed? 4. Journal?” 6. Paper trade for 3 weeks. Log every trade. 7. Review every Sunday. Ask: “Did I follow my plan? Where did I fail?” You don’t need to be perfect. You just need to be consistent.Do I need a trading plan if I’m only trading occasionally?

Yes. Even if you trade once a week, you still need rules. Without them, you’re relying on luck. A simple plan-even just a one-page checklist-keeps you from making emotional decisions when you do trade. Consistency matters more than frequency.

Can I use the same plan for stocks, forex, and crypto?

You can adapt the structure, but you can’t copy-paste. Crypto moves faster and has wider swings than stocks. Forex is influenced by global news. Your risk limits and entry triggers must match the asset. For crypto, use ATR-based stops, not fixed dollar amounts. For stocks, account for earnings gaps. Tailor your plan to the market’s behavior.

How do I stop overriding my stop-loss?

Move your stop-loss before you enter the trade. Then lock your platform. Don’t look at it. If you feel the urge to move it, walk away for 10 minutes. The urge to chase losses is a psychological pattern, not a market signal. Use the 3-strike rule: three times you override your plan, and you take a 24-hour break. This breaks the cycle.

Is automated trading better than manual trading?

It’s not better-it’s different. Automation removes emotion, which helps 43% of traders. But it also removes accountability. If your bot fails, you need to know why. Use automation for execution, not strategy. Always monitor your system. Never fully hand over control. The best traders combine automation with manual review.

How do I know if my trading plan is working?

Look at your journal. Are you hitting your risk limits? Are you following your entry rules? Are your win rates stable? Are your drawdowns under control? If your plan is working, your emotions become quieter, your trades become more predictable, and your account grows steadily-not in spikes. If you’re still feeling anxious after every trade, your plan isn’t working yet.

What if my plan doesn’t work for a month?

Don’t scrap it. Review it. One bad month doesn’t mean your strategy is flawed. Markets change. Maybe volatility spiked. Maybe you stopped journaling. Check your adherence rate. If you followed your plan 90% of the time and still lost, then tweak your entries or risk levels. If you only followed it 40% of the time, the problem isn’t your plan-it’s your discipline.

Eric Etienne

November 27, 2025 AT 02:10Ugh here we go again with the ‘write a plan’ nonsense. I’ve got 3 notebooks full of plans. None of them saved my account. The market doesn’t care if you checked off a box. It just eats you alive if you’re not already a robot. I’m done pretending discipline is the answer.

Dylan Rodriquez

November 29, 2025 AT 01:43I get where Eric’s coming from - the system doesn’t always work, especially when life throws you curveballs. But discipline isn’t about being perfect. It’s about showing up even when you’re tired, broke, or scared. The plan is just the map. You still have to walk the road. And sometimes, you’ll stumble. That’s okay. Just don’t quit walking.

Amanda Ablan

November 29, 2025 AT 12:51Actually, the checklist thing saved me. I used to trade like a drunk squirrel on caffeine. Now I have a sticky note on my monitor: ‘Trend? Risk? Stop? Journal?’ I say it out loud before I click. Sounds dumb. Works like magic. No more revenge trades. No more ‘just one more’.

Meredith Howard

November 30, 2025 AT 18:05The notion that a written plan guarantees consistency is a fallacy rooted in behavioral economics. Human beings are not rational actors. Even with rigid rules, emotional override occurs due to cognitive dissonance triggered by loss aversion. A plan without psychological scaffolding is merely a ritual. True adherence requires habit formation, not documentation.

Yashwanth Gouravajjula

November 30, 2025 AT 19:15In India, we say: ‘Plan is good, but patience is god.’ Trade small. Wait. Don’t force. Market will come to you. If you chase, you lose. Simple.

Kevin Hagerty

December 2, 2025 AT 08:29LOL you guys actually believe this crap? ‘Write it down’ ‘checklist’ ‘journal’ - like that’s gonna stop you from being a dumbass when your BTC pumps 30% and you’re broke. I’ve seen 1000 traders with perfect plans blow up. The only thing that works? Luck. Or being born with zero emotions. I’m not either.

Janiss McCamish

December 4, 2025 AT 06:51Try this: if you break your rule once, you owe yourself a 10-minute walk. No phone. Just breathe. That pause breaks the spiral. I did it for 30 days. My win rate jumped. Not because I got smarter - because I stopped being a reactive mess.

Richard H

December 4, 2025 AT 23:50USA made me a trader. Not some fancy checklist. We don’t need rules. We need guts. You want discipline? Go short during a Fed meeting. That’s discipline. Not writing down ‘trend aligned.’ Real traders don’t need paper. They need nerve.

Kendall Storey

December 6, 2025 AT 17:32Automated execution + manual review = the holy grail. I use TradingView alerts to trigger entries, but I still sit there with my coffee and stare at the chart before confirming. Automation removes panic. Manual review keeps me honest. No bot should ever trade without a human in the loop. Period.

Ashton Strong

December 7, 2025 AT 09:21It is imperative to recognize that the development of a structured trading protocol is not merely an operational exercise, but a profound act of self-regulation. The journal, in particular, functions as an epistemic mirror - reflecting not only trade outcomes, but the underlying cognitive patterns that drive them. Consistency, therefore, is not a behavioral target, but a philosophical commitment.

Aafreen Khan

December 8, 2025 AT 05:38bro u just need to buy the dip and hold 😎💰 no plan needed. i made 100k in 3 months with just binance and vibes. u overthinkin lol 🤡

Pamela Watson

December 9, 2025 AT 21:25Wait wait wait - you’re telling me I have to WRITE things down? Like, physically? On paper? What if I forget? What if I lose the notebook? What if I’m on vacation? I just want to trade. Why is this so complicated? I thought trading was supposed to be easy?? 😭

michael T

December 10, 2025 AT 20:11Man I used to be like you - all ‘checklists’ and ‘risk limits.’ Then I went full berserk on a crypto pump. Lost my rent money. Cried in a 7-Eleven parking lot. Now I trade with my gut. My gut doesn’t lie. My plan did. Fuck discipline. I’m on vibes now. And guess what? I’m up 300% this year. You’re welcome.

Christina Kooiman

December 11, 2025 AT 12:13There is a fundamental flaw in the entire premise of this article - and I say this as someone who has spent over 12,000 hours analyzing trading psychology - the notion that ‘discipline’ can be engineered through external structures like checklists or journals is a gross misinterpretation of behavioral conditioning. Discipline is not a tool - it is a state of being cultivated over time through repeated exposure to consequence, not through procedural compliance. The checklist is a crutch, not a cure. And anyone who tells you otherwise is selling you a fantasy dressed in bullet points.